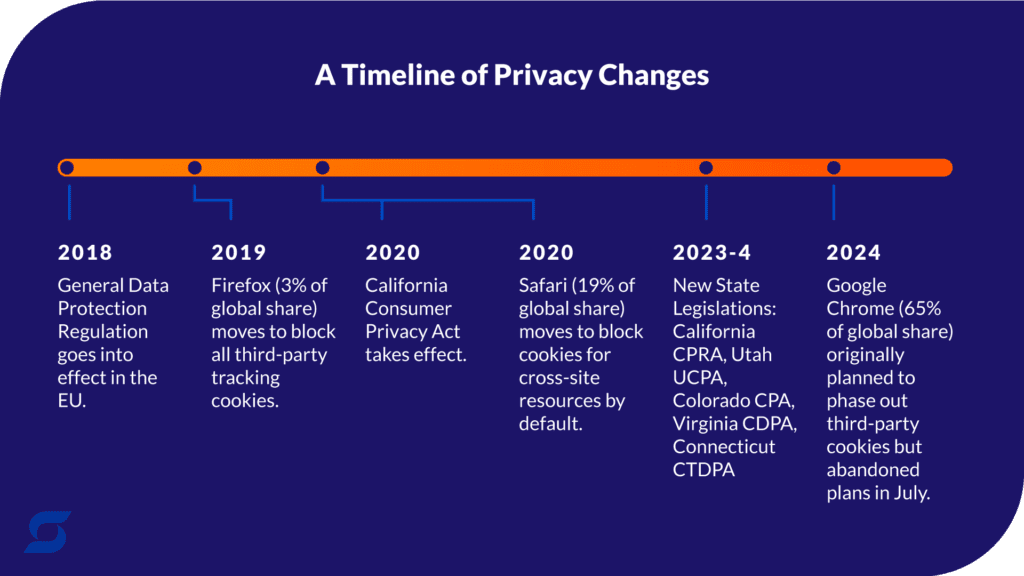

In early January 2024, Google began their initial phaseout of cookies. They implemented what they are called “tracking protection” to 1% of Chrome users (around 30 million users) globally. The plan was initially to fully remove cookies starting in the third quarter of 2024.

The industry and other technology companies were skeptical about Google’s Privacy Sandbox solution. While some embraced it, others began testing (or building) alternative solutions from other DSPs, SSPs, and data providers.

In July 2024, Google abandoned their plan to phase out cookies in Chrome. They’re instead taking an approach that allows Chrome users to choose their own privacy options. So while cookies aren’t disappearing altogether, moving forward with less dependence will be key.

What are cookies, and why is depreciation (potentially) such a big deal?

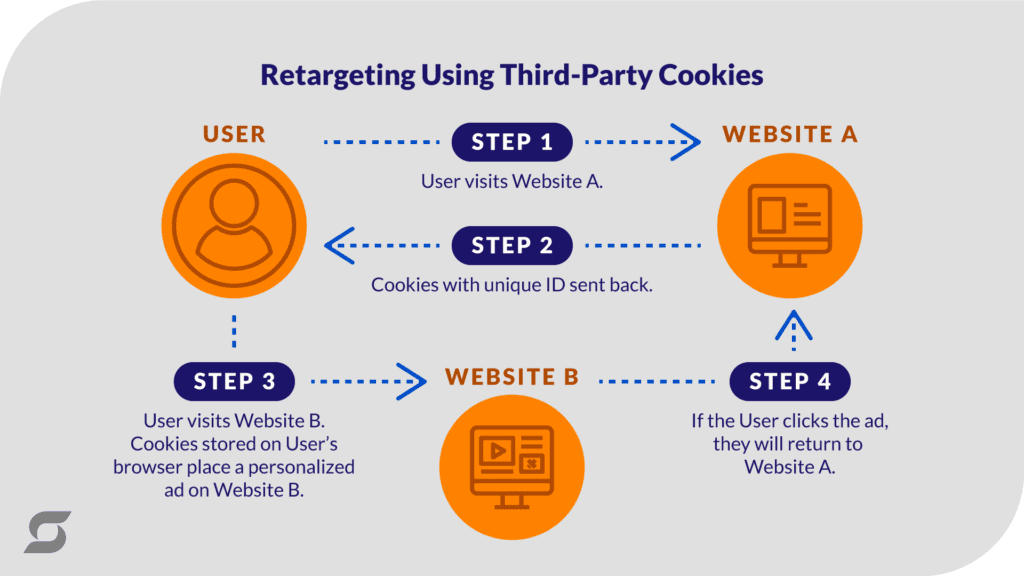

Third-party cookies are created by domains other than the one you are visiting directly. They are used for digital marketing, in cross-site tracking, retargeting, and ad-serving. They allow you to target consumers throughout the web via audience targeting, to gather behavioral data on consumers, and to track the consumer’s journey across devices and sites.

Third-party cookies have been a critical part of advertising and user experiences among the web for 30 years. The use has continuously faced criticism as a non-privacy centric means nor a sustainable method. However, third-party cookies have been so deep-rooted that other privacy measures were enabled to counteract the negative implications, until now

Finding cookieless solutions in itself is not a new concept. DSPs, tech partners, and audience providers have built (or re-built) their offerings on non-cookie based solutions in the wake of the removal.

The “fuss” in the industry was due to Google’s lion-share of internet ownership. Chrome makes up for over 60% of internet browsing, and it is also the largest advertising powerhouse. It owns both an ad server (Google Ad Manager) and a demand-side platform (DSP) as well.

What are the solutions today?

The anticipation around Google’s announcements forced the industry to step up to find a viable replacement. Ad tech companies and advertisers are continuing to test the various solutions and determine which is most compatible with their own marketing efforts.

The top alternative solution has been led by The Trade Desk and their UID2.0 solution. In lieu of cookies, it is built off of email addresses as the main identifier.

Lotame is a data management and identity platform, which has built their own alternative ID solution. They have decided to adopt UID2.0 instead of Privacy Sandbox. Lotame’s head of identity, Eli Heath said, “There’s not really going to be a winner takes all in the ID space, and to preserve Lotame audience activation for our buyer clients, we really wanted to take kind of a multi-pronged approach, and I’ll say hedge our bets.”

Viant, another leader in the DSP space, built their identity graph on people-based identifiers (phone number, email, physical address, IP) to build their Household ID. It enables brands to scale and attribute media to deterministic households without the use of cookies.

Across all platforms, media buying is already shifting towards cookieless environment channels, such as CTV or walled gardens. But the measurement and targeting accuracy are still impacted.

What can you do, and how can Scale Marketing help?

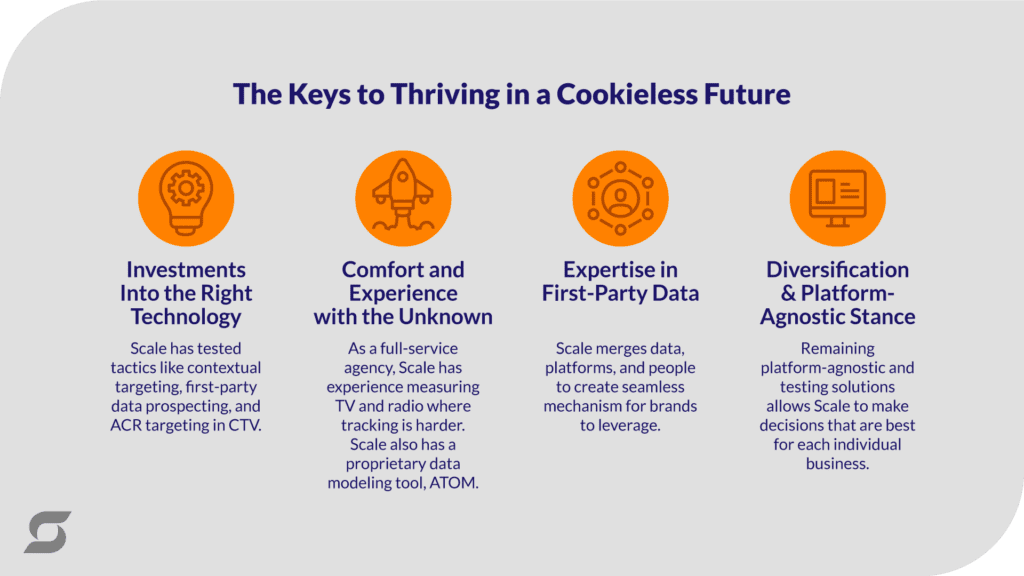

Invest in the right technology:

Scale Marketing holds many seats on the best DSPs out there. They have been vetted for their cookieless solutions.

Data Clean Rooms, DMPs (Data Management Platforms) or CDPs (Customer Data Platforms) are useful for brands looking to further segment their first-party data. CRM systems often have direct integrations with these platforms or even offer segmentation services themselves.

Scale trading teams have continued to test cookieless audiences in the DSP and other platforms on behalf of our clients. We are well-prepared to continue to scale successful digital campaigns. These tactics include, but are not limited to:

- Contextual targeting (serving targeted ads based on page/URL context)

- First-Party Data Prospecting (LALs, Machine learning audiences, Predictive segments)

- ACR targeting in CTV (using hardware technology to competitively conquest, target by content or genre, suppress from linear)

Get comfortable with the “unknown”:

Measurement of digital advertising is likely to take a hit in the months to come. Signal loss and accuracy of conversions will be roadblocks to measuring direct outcomes. We may need to approach measurement like we do for TV, Radio, and many tactics on Meta (due to attribution changes in 2021). We will need to use impressions ran and real business data results to measure return and to optimize our media mix for efficiency.

Data science studies and modeling will play a large role. Tools like Scale Marketing’s proprietary ATOM help determine the effectiveness and synergistic effect of media. They’re especially useful where there are holes in in-platform measurement.

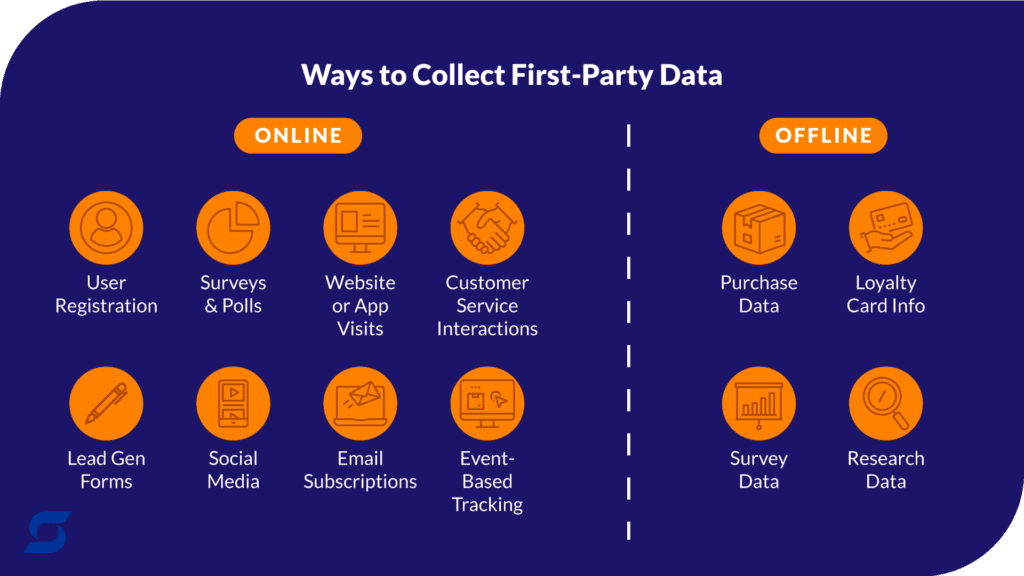

Recognize the importance of first-party data:

Define and execute a first-party data strategy. All brands, regardless of industry, need to have a firm understanding of their customer data. They need a plan in place to standardize taxonomy and implement frameworks for customer segmentation, analysis, and activation.

Brands’ first party data will have enormous value in the near future. First-party data isn’t scalable on its own. The advertising solutions of the future will rely on multiple platforms, people, and sources of data. All must come together to create a seamless mechanism for advertisers to leverage.

Diversify:

Scale plans to remain platform agnostic. Time will tell what the best viable solution or solutions is. By not “picking a side”, we position ourselves and our clients in an advantageous spot. We can make decisions that are best for each individual business and get an unbiased lay of the land.

Get in touch to learn more about how Scale Marketing uses insights to drive growth and business results for companies like yours.